Business Insurance in and around Chesapeake

Chesapeake! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Your Search For Fantastic Small Business Insurance Ends Now.

You may be feeling like there's so much to think about with running your small business and that you have to handle it all on your own. State Farm agent Rita Keels, a fellow business owner, is aware of the responsibility on your shoulders and is here to help you get started on a policy that's right for your needs.

Chesapeake! Look no further for small business insurance.

Helping insure businesses can be the neighborly thing to do

Cover Your Business Assets

Did you know that State Farm has been helping small businesses grow since 1935? Business owners like you have turned to State Farm for coverage from countless industries. It doesn't matter if you are a lawn care service or a physician or you own a travel agency or an ice cream shop. Whatever your business, State Farm might help cover it with customizable policies that meet each owner's specific needs. It all starts with State Farm agent Rita Keels. Rita Keels is the person who understands where you are firsthand because all State Farm agents are business owners themselves. Contact a State Farm agent to gather more information about your small business insurance options

It's time to call or email State Farm agent Rita Keels. You'll quickly recognize why State Farm is one of the leaders in small business insurance.

Simple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.

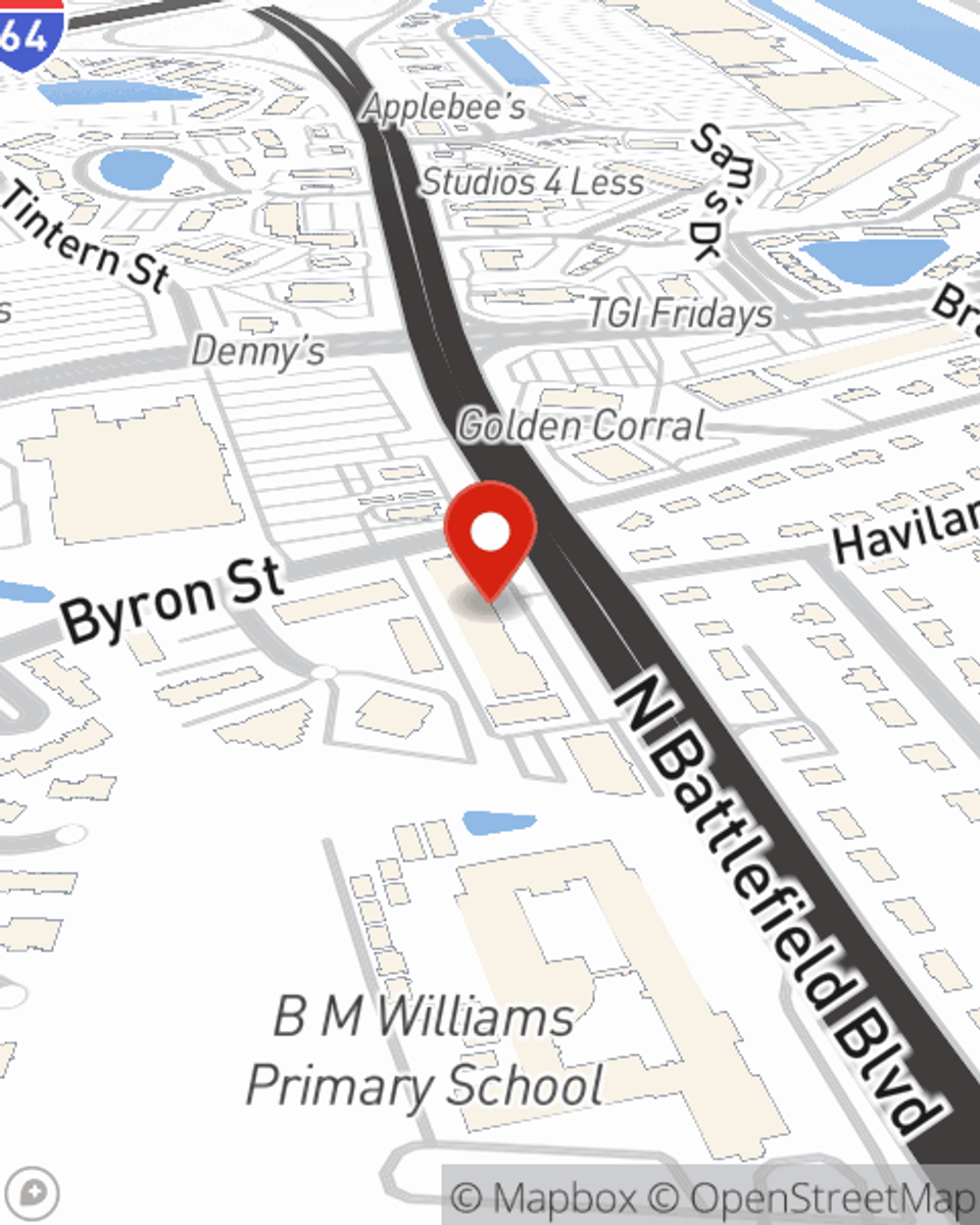

Rita Keels

State Farm® Insurance AgentSimple Insights®

Small business benefits to offer

Small business benefits to offer

Benefits are a crucial part of a compensation package. Let’s take a look at some common small business benefits packages.

Money management strategies for the self-employed

Money management strategies for the self-employed

Working for yourself and managing money can be challenging. Create money management strategies to help your business thrive.